Paying back a percentage of your debt instead of the full amount may seem like a catchy deal, and the truth is, it is. However, calculating the ripple effect of your actions is essential when working with debt settlement companies. It is a significant undertaking requiring you to do your homework and background research before enrolling or signing up in any program. In your search for a debt settlement company to work with, you may have come across a myriad of debt relief companies including … [Read more...]

Hard Money Loans Connecticut: Why Real Estate Investors Should Take Advantage of It

Connecticut is a thriving state and there are many people who wants to invest in real estate here. However, not all have the cold cash to invest � so they usually consider obtaining a hard money loan. To truly grasp the concept of hard money loans Connecticut, more than a cursory overview is required. Borrowers must understand their eligibility for specific financial situations, as well as the benefits and drawbacks of their use. Borrowers must also understand that not all lenders and lendin … [Read more...]

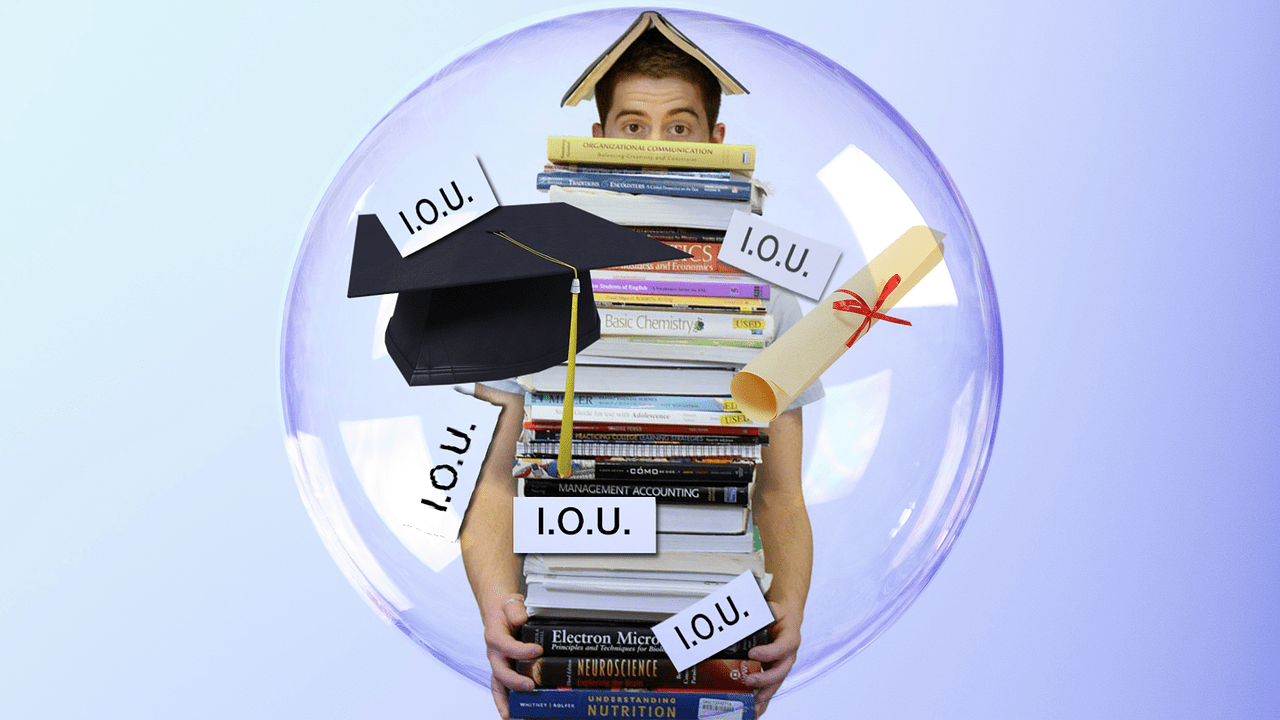

The Tops 5 Student Loan Forgiveness Programs

Student loan forgiveness is not a quick fix solution that can solve your student debt problems overnight. But they can help you get rid of all or some of your remaining balance over time. The federal government designed most loan forgiveness programs for borrowers who work in public service, education, health care, and other fields for a specific period. Some states even help graduates with massive loans to pay off their debt. If you're finding it difficult to pay off … [Read more...]

5 Things To Do Before Applying For a Home Loan

Whether it's you're a first time home buyer or you're a seasoned veteran, there are certain things you should do before submitting your loan application. Take a look at some of the best tips to help you with the process of applying for a home loan. Pay Your Bills On Time If there's one thing you should do to improve your chances of run approval, you should make sure that you pay all of your bills on time. Late payments can negatively affect your credit score, which plays a … [Read more...]

Loan Options for Bad Credit

Among the most popular loan products in banking, personal loans quickly became popular after the global credit crunch of 2020. Borrowers now can take out a personal loan for any number of different reasons, but most commonly, borrowers are opting for a personal loan to consolidate credit card debt into one loan with a much lower interest rate. This is a great way to improve your credit score, and many lenders are willing to work with you. Personal loan rates vary from lender to lender, and it is … [Read more...]

Things You Should Avoid if You Get a Personal Loan

Hey! You have cash now on your bank account thanks to that personal loan you took. Now you can start your own business, take care of your payroll or even get the supplies you need for the company, right? Wrong. Business and personal loans are not the same, even though you'll get them and have free range to use them. A personal loan is meant for... well, personal things like better education or to improve your home. And they have collateral specific to you as a person, the stuff you own. … [Read more...]

Need Quick Cash For Business Purpose? Here�s What To Do

Sufficient capital is a vital aspect of any financially healthy business. Having less working capital can affect your business in the future. Many entrepreneurs apply for external funds to top up on the working capital to grow their company. These funds can be used for purposes, including business expansion and the addition of stock. Either way, every business has its challenges, but it pays to be prepared. Discussed below are six ways to raise some quick cash for business purposes. Loan … [Read more...]

How Your FICO Credit Score Affects Your Mortgage Loan Application

Even though a house is its own collateral, most lenders have credit score requirements before awarding a home loan. Credit scores offer a relatively accurate glimpse of a borrower's credit history and debt status. Despite the ubiquity of the credit scores, many borrowers do not understand how exactly they work and why they are so important to lenders. The credit score that most lenders use is called a FICO Score. This score is not the only tool that lenders use to determine … [Read more...]