Investing in the European market can be a lucrative opportunity for financial growth, but it’s essential to choose the right trading platform to ensure a smooth and successful investment experience. With so many options available, it can be overwhelming to determine which platform best fits your needs.

In this article, we will provide tips on how to choose a European trading platform that meets your investment goals and preferences. From fees and security to user-friendliness and market access, we’ll cover the key factors to consider when deciding. Whether you’re a seasoned investor or new to the market, these tips will help you find the right trading platform to support your financial goals.

Tips on how to choose a European trading platform to invest

There are a few key factors to consider when choosing a the best trading platforms in Europe:

Regulation: Ensure the broker is regulated by a reputable authority, such as the Financial Conduct Authority (FCA) in the UK or the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. This will ensure that your investments are protected and that the broker follows certain guidelines to protect your interests.

Fees: Compare the fees charged by different brokers to make sure you’re getting a good deal. Look for brokers with low commission fees, especially if you plan to trade frequently.

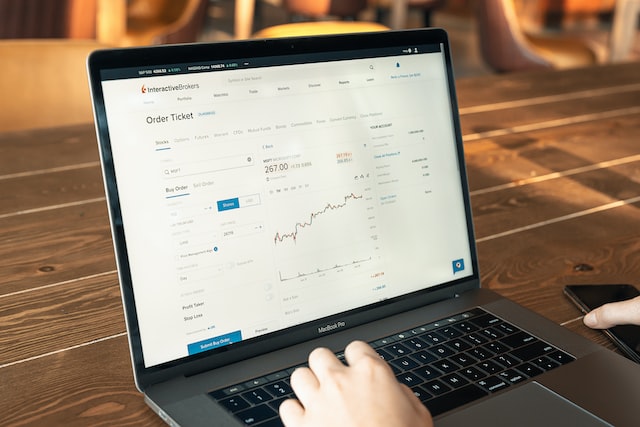

Trading platforms: Choose a broker that offers a trading platform that is easy to use and has the features you need. This may include advanced charting tools, market news, and research resources.

You should also check each broker’s country availability. For instance, if you like Webull, Robinhood, or TD Ameritrade, you are in bad luck. They are unavailable in the UK. Hence, you should research some Webull UK alternatives and TD Ameritrade alternatives.

Customer service: It’s important to choose a broker that offers good customer service in case you have any questions or issues. Look for brokers with multiple support channels, such as phone, email, and live chat.

Asset class coverage: Consider what types of assets you want to trade and ensure the broker offers access to those markets. For example, if you want to trade stocks, choose a broker that offers a wide selection of stocks from various exchanges.

Account minimums: Some brokers have minimum account balance requirements, so choose one that aligns with your investment goals and budget.

Reputation: Research the reputation of the platform and its parent company. Look for well-established platforms with a good track record of customer satisfaction.

Extra features: Some platforms may offer additional features such as mobile trading apps, advanced charting tools, or the ability to automate trades through algorithmic trading. Consider whether these features are important to you and whether they are worth any additional fees.

Overall, it’s essential to research and compare multiple brokers before making a decision. It may also be helpful to read reviews from other investors and consult with a financial advisor.

Wrapping Up

In conclusion, choosing the right European trading platform is an essential step in maximizing the potential of your investment strategy. By considering factors such as fees, security, user-friendliness, market access, and reputation, you can narrow down your options and select a platform that meets your needs and aligns with your investment goals.

Don’t be afraid to do your research and ask questions before making a decision. With a little due diligence and careful consideration, you can find a trading platform that supports your financial success in the European market.

Hey welcome to my blog . I am a modern women who love to share any tips on lifestyle, health, travel. Hope you join me in this journey!

Speak Your Mind